Export Credit Agencies

- Home

- Export Credit Agencies

About ECAs

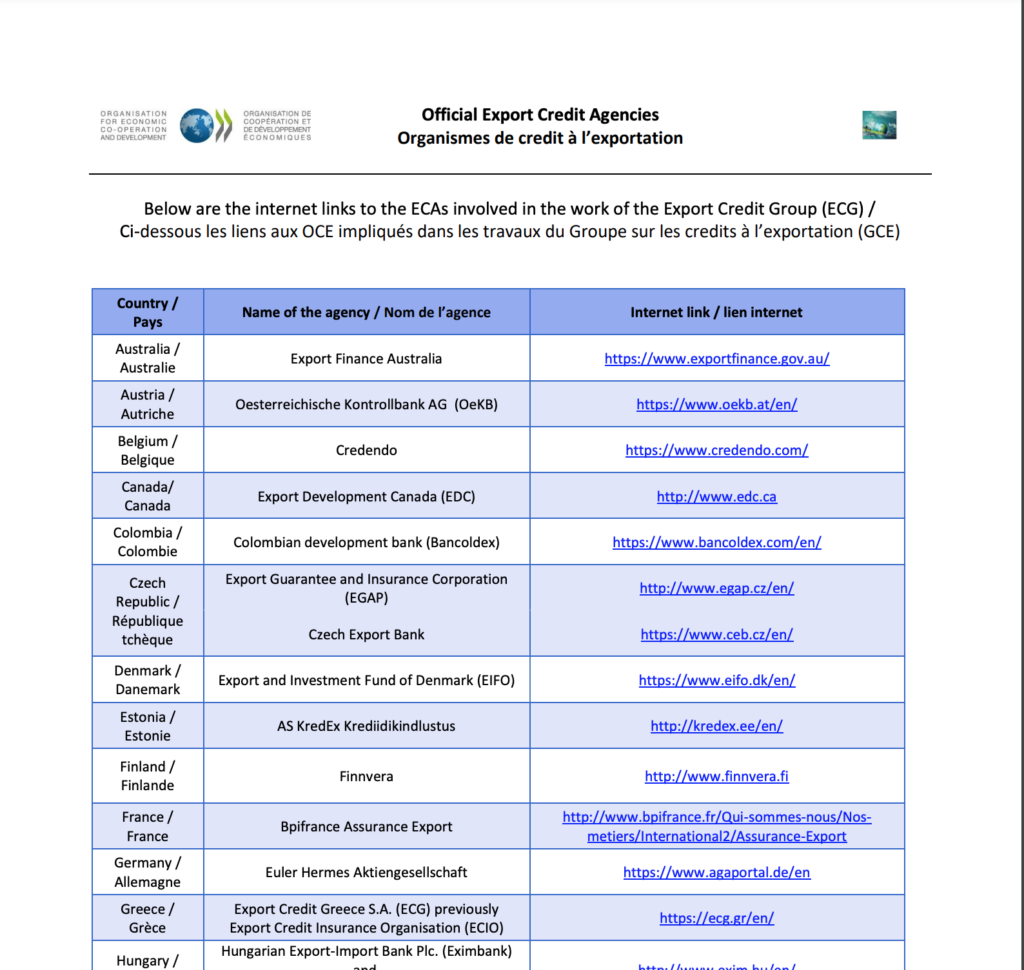

Export Credit Agencies and Investment Insurance Agencies, commonly referred to as ECAs, provide government-backed loans, guarantees and insurance to corporations seeking business opportunities in developing countries and emerging markets. Their mandate is to promote their own countries’ exports and foreign investments. ECAs can be organized as stock corporations under private law and then endowed with the mandate to handle credit guarantees of their respective government. In such cases, the relationship can be compared to a trusteeship; Examples include Germany’s and France’s ECA. ECAs can also be plain public agencies, established by law, such as the U.S. EX-IM Bank and the British Export Credit Guarantee Department. ECAs’ main fields of activities include:

Export credits, typically provided by ECAs either directly as a loan, with repayment terms generally from 2 to 10 years, or indirectly as insurance or a guarantee provided by an ECA to support a commercial loan. Export credit insurance covers two types of risk — commercial and political. The former refer to the buyer’s own ability to pay for the goods delivered, the latter to dangers arising out of country-specific problems such as the cancellation of an import license, war, or the prevention by the authorities in the buyer’s country of the transfer of the foreign exchange required to pay the supplier.

Investment insurances cover the political risks connected to an investment overseas, i.e. against losses in the host country due to expropriation, war, confiscation or nationalization, inconvertibility of profits or dividends, or transfer inability of currency.

Export Credit Agencies are collectively the largest sources of public financial support for foreign corporate investment in, and trade with, the developing world. Export Credit Agencies (ECAs) are major players in

international trade and investment, providing state backing for

large-scale business transactions that span the globe.

How It Works & How We Do It

We are working in the format of an outsourcing project office. We assume operational coordination and control over the compliance with all project implementation parameters that ensures the execution of works on time.

Integrating of innovation and public benefit into your workflows; ensuring strategic and sustainable development of your organization from project.

marketing analysis

finance strategy

business innovation

CORPORATE MANAGEMENT

“I cannot give you the formula for success, but I can give you the formula for failure. It is: Try to please everybody.” david oswald

Business Planning & Strategy

In what areas do you provide management consulting?

Successful experience of experts in structuring investment projects, developing and implementing construction, developers and energy projects, restructuring programs, etc. provides a positive impact on your company profitability.

In which countries do you provide consulting services?

Successful experience of experts in structuring investment projects, developing and implementing construction, developers and energy projects, restructuring programs, etc. provides a positive impact on your company profitability.

How is a consulting project started and organized?

Successful experience of experts in structuring investment projects, developing and implementing construction, developers and energy projects, restructuring programs, etc. provides a positive impact on your company profitability.